tax lien sales in memphis tn

Tax Deed Sales In Tennessee TN. To participate in online.

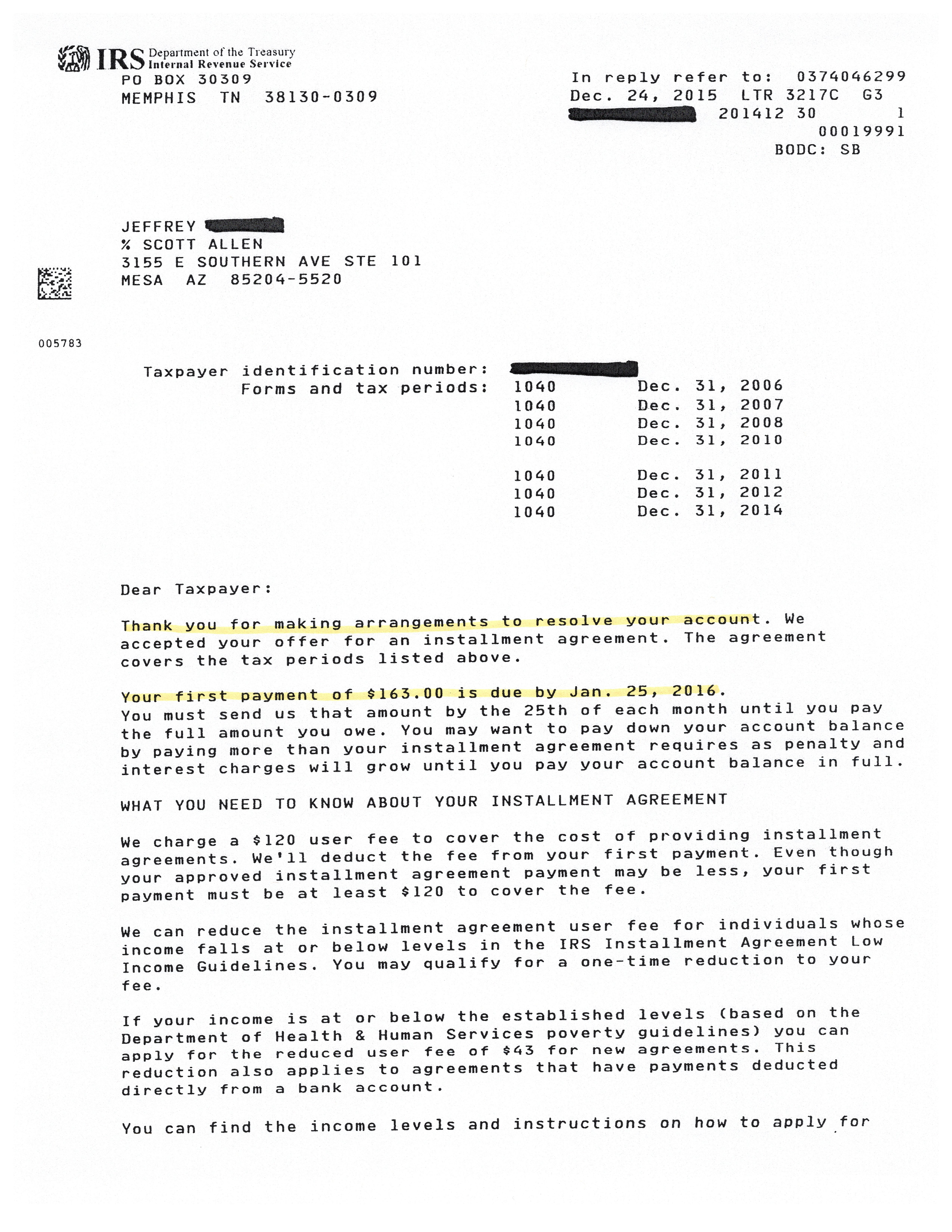

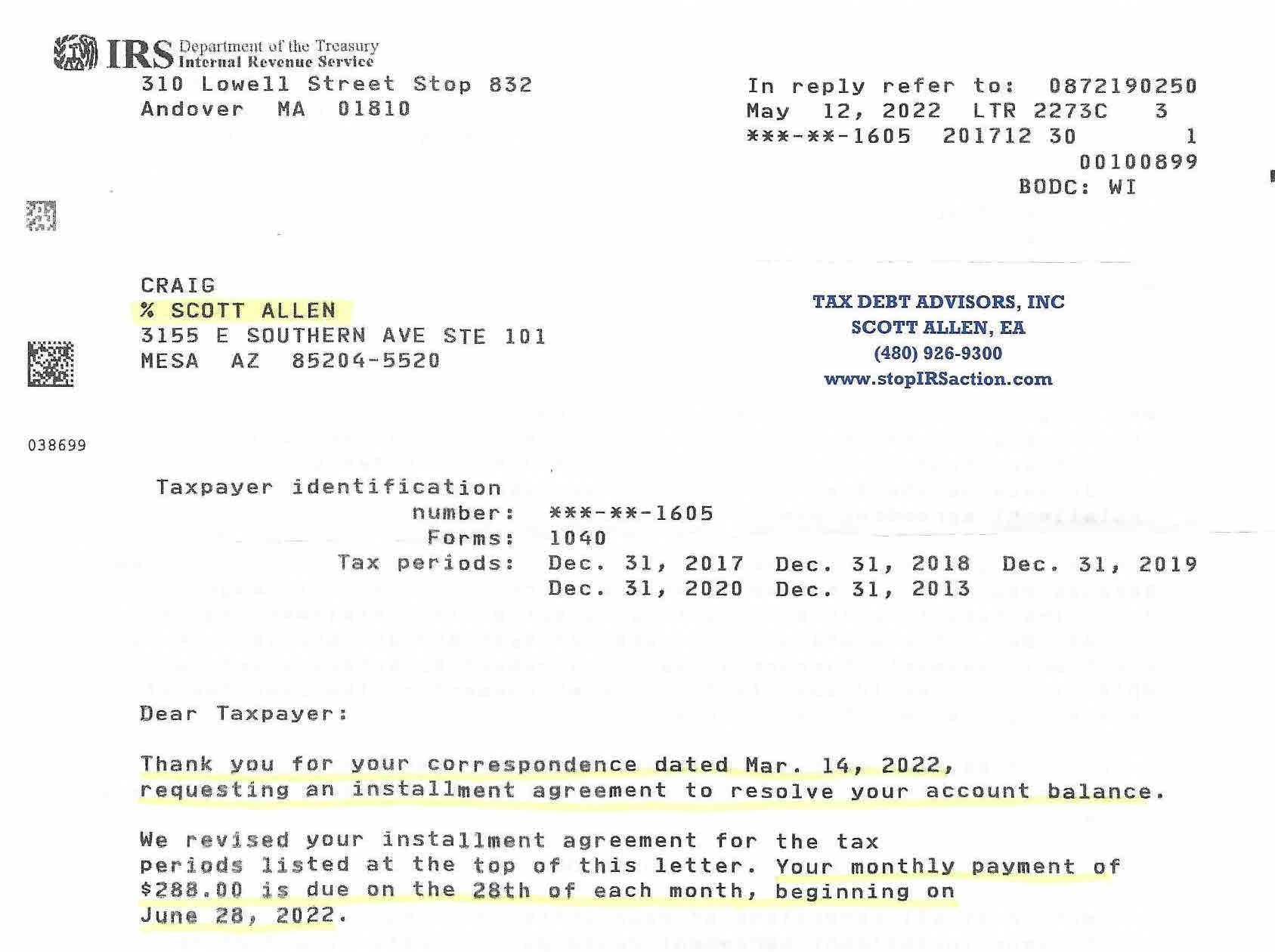

Irs Accepts Installment Agreement In Des Moines Ia 20 20 Tax Resolution

Find the best deals on the market in Memphis Tennessee and buy a property up to 50 percent below market value.

. Memphis TN currently has 1036 tax liens available as of July 21. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Tennessee is a decent state for tax deed sales.

Search CareerBuilder for Tax Lien Sales Jobs in memphisTN and browse our platform. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Effective January 19 2016 the Chancery Court Clerk and Masters Tax Sales will be held online by Civic Source.

Just remember each state has its own bidding process. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Memphis Tn 38122 at tax lien auctions or online distressed asset sales. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

Ad Find Tax Lien Property Under Market Value in Memphis. Memphis Tennessee tax liens available in TN. The Shelby County Trustee does not offer tax lien certificates or make over the counter sales.

If you receive a notice that you owe money to the Department of Revenue it is extremely important to contact us immediately in order to avoid collection actions. Memphis TN 38101. Sign up for E-Newsletter Home.

There are currently 45 red-hot tax lien listings in Memphis TN. S tate only conducts tax deed. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner.

Compare Tax Lien in Memphis TN. The purchaser will either receive what they paid to satisfy the delinquent property taxes plus interest and or penalties or receive a tax deed title obtained through tax foreclosure process which conveys all right title and interest of county in the property including all delinquent taxes which have. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership.

See reviews photos directions phone numbers and more for the best Property Maintenance in Memphis TN. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Memphis TN at tax lien auctions or online distressed asset sales. Memphis Tn 38122 currently has 180 tax liens available as of April 11.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. In addition the list of properties offered at the tax sale will also be advertised in the Memphis Daily News between 30 - 45 days before the opening day of the tax sale. Shop around and act fast on a new real estate investment in your area.

Ad Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Memphis Tn 38109 at tax lien auctions or online distressed asset sales. A complete listing for each sale may be printed for your convenience or information may be printed according to a specific page number.

View 6 in Memphis TN. The Chancery Court Clerk Masters Office is responsible for conducting public auctions for delinquent real estate property taxes in Shelby County for both City of Memphis and Shelby County and the municipalities within Shelby County. If you do not see a tax lien.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Memphis Tn 38109 currently has 1169 tax liens available as of March 24. Special Notice to Tax Sale Bidders. Properties in Shelby County are subject to sale at public auction for non-payment of property taxesThe purpose of the tax sale is to collect the unpaid taxes and to convey the tax-defaulted property to a responsible owner.

Enjoy the pride of homeownership for less than it costs to rent before its too late. Properties for each sale are listed in parcel number order. Generally there are two outcomes with the sale of Tennessee tax deed hybrid.

Apply now for jobs that are hiring near you. Please contact us at RevenueCollectiontngov. Access business information offers and more - THE REAL YELLOW PAGES.

Search for your dream home today. Tennessee tax lien certificate auctions. Check your Tennessee tax liens rules.

What Is A Notice Of Federal Tax Lien Rush Tax Resolution

Pin By Reoclose Com On Wholesale Real Estate Wholesale Real Estate Real Estate Office Real Estate Search

Is Tennessee A Tax Lien Or Tax Deed State

Do You Pay Taxes When You Sell A House In Memphis Fair Cash Deal

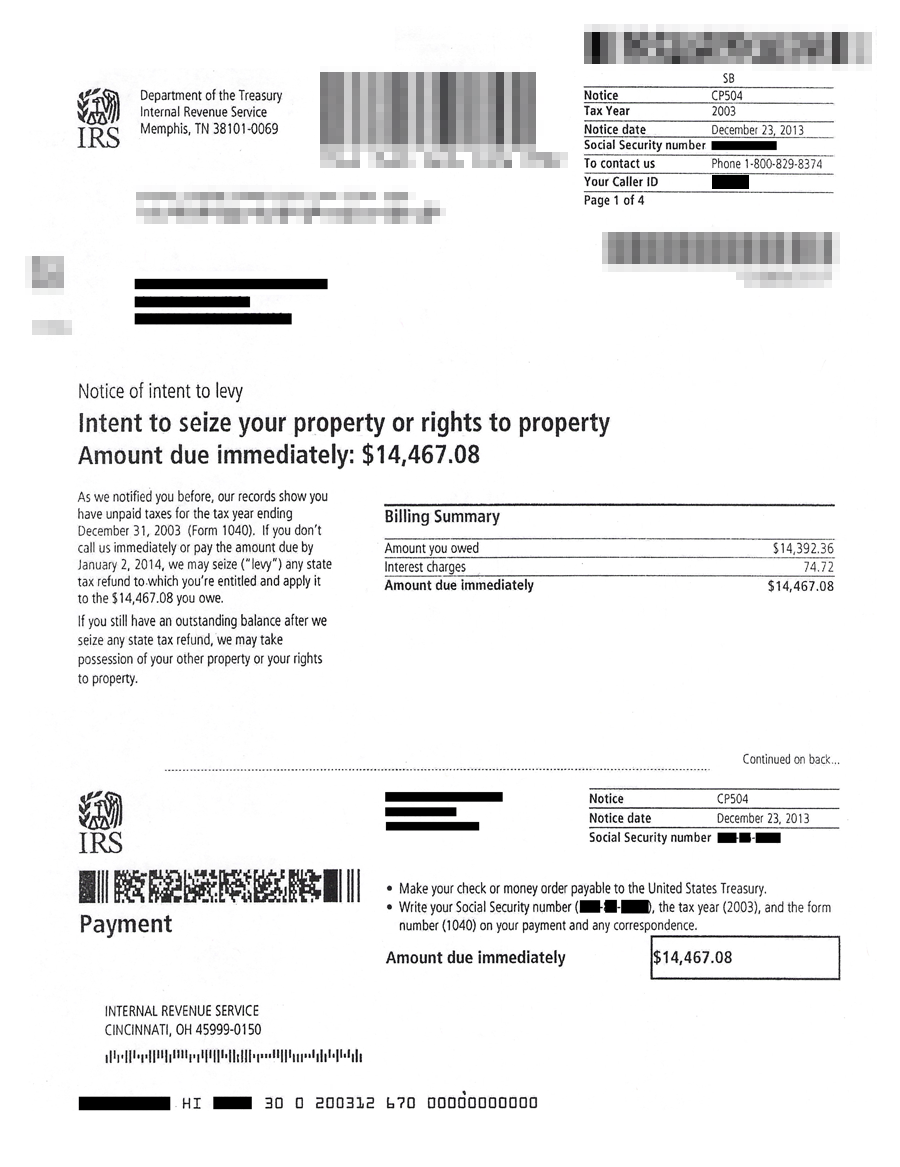

Irs Tax Lien Problems Tax Debt Advisors

Tennessee Tax Sales Explained Tax Liens Tax Deeds A Private Goldmine For Investors Youtube

Tax Defense Attorneys Legal Tax Defense

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Is The Memphis Tax Sale Worth The Investment Risk Homevestors Franchise

Legal Tax Defense Tax Defense Attorneys

Irs Tax Lien Problems Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

Irs Just Sent Me A Balance Due Notice Cp 14 What Should I Do Legacy Tax Resolution Services

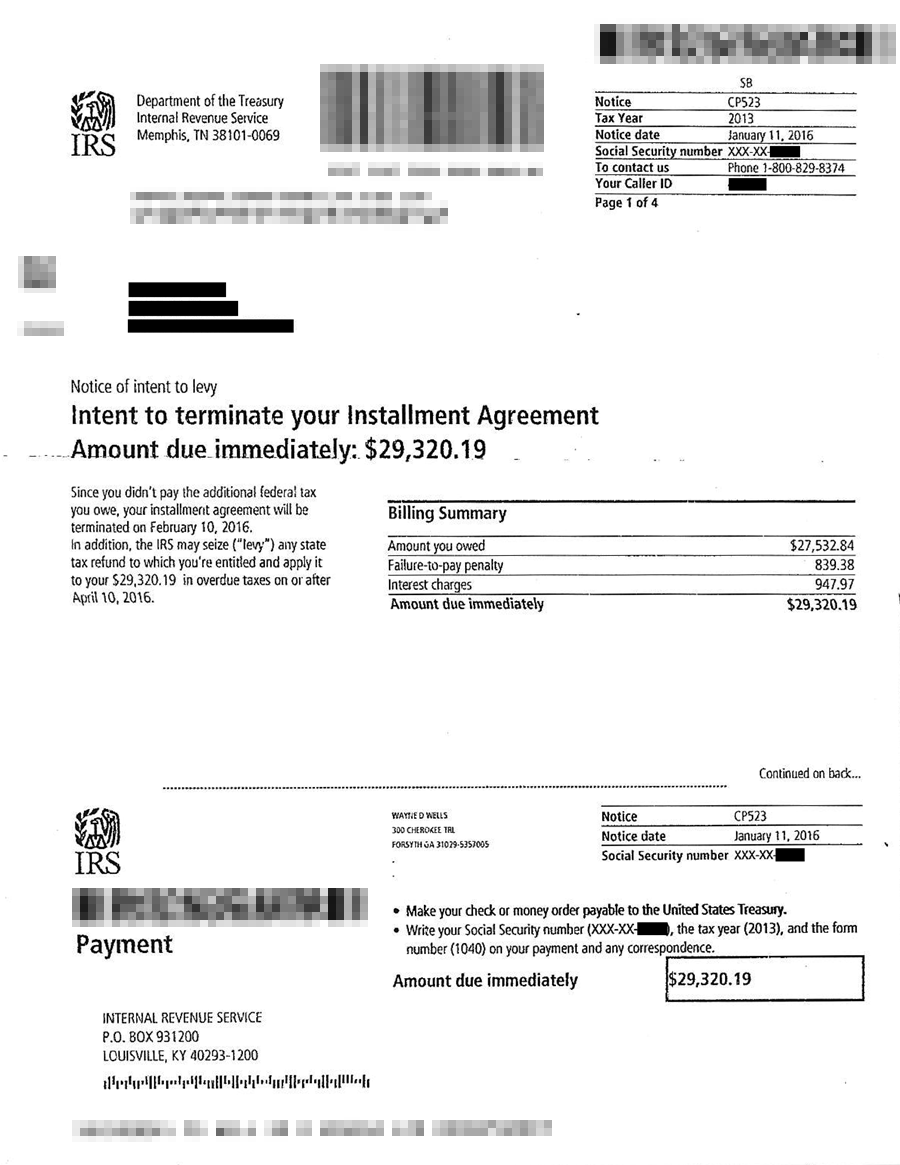

Irs Accepts Installment Agreement In Memphis Tn 20 20 Tax Resolution